PDF Bookroll: Upload a commercial policy from any agency management system to your carrier. If we’re connected to the carrier, the InsureZone platform will rate it in real time. More...

PDF Rater: Upload a PDF of your commercial client and InsureZone will take the data for that client and populate its commercial application with the information pulled from your management system. If there is any information missing or your carrier requires some additional questions to be answer, the online application will prompt you to complete those questions before returning proposals from all available carriers. More...

IZ Mobile: Rate, Quote and Bind online all from the InsureZone Mobile App. Submit an application for Auto, Home or Commercial Insurance through the InsureZone mobile app, and receive proposals back in just seconds. Once you’ve reviewed quotes, you can bind the policy online right from your mobile device. More...

App Prefill: For Home, and soon to be Auto and Commercial Property, with just a few basic questions like name and address, InsureZone will prefill all of the remaining application questions with the information needed to retrieve a proposal from all available carriers. More...

DropZone: An Outlook Add-in that allows the user to drag and drop documents from their desktop or from any Outlook email into the InsureZone platform. More...

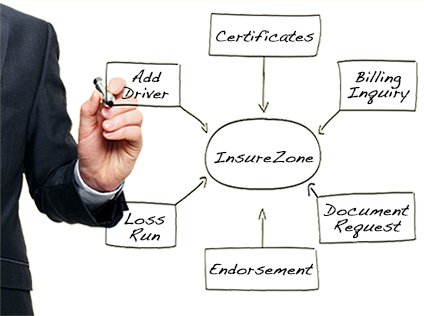

POLICY SPOT: 24/7 Automated Service Department

Manage your online service request submission, tracking and policy documentation.More...

MGA PRO: Surplus Lines Rating

MGAPro provides instant Surplus Lines quotes, including taxes and fees.More...

Remarket: Policy Renewal Manager

Systemize your renewal process by re-quoting your policies with current policy details from your agency management system.More...

FETCH: Policy Document Retriever

Automate carrier document retrieval, e-mail distribution and storage.More...

CLOWSER: Appetite and Underwriting Rules Engine

Streamline your online interface for carrier appetite and underwriting rules.More...

AL3NOW: AL3 File Management

Turn your AL3 data into useful, reportable information.More...

BOWSER: Web Scripting Genie

Automate any repetitive internet browser process.More...

REPORTCAST: Administrative Reporting Tools

Simplify reporting for your sub-agents and producers.More...

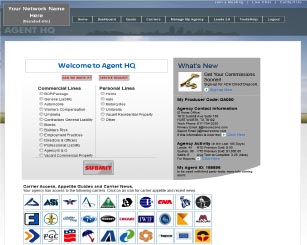

INSURERATER: Online Comparative Rater

Power your online quoting with our self-service comparative rater for personal and commercial lines.More...

MEMBER ONE: Agency Relationship Toolset

Manage your sub-agent application and approval processes, licensing, E&O and agency communications.More...

FIDO: Sales Workflow Management

Consolidate your workflow from submission to closed sales, along with e-mail integration and document management in one place.More...

CarrierData

Manage all of your carrier producer codes, usernames, passwords, contact information and state and line of business availability in one central location.

More...

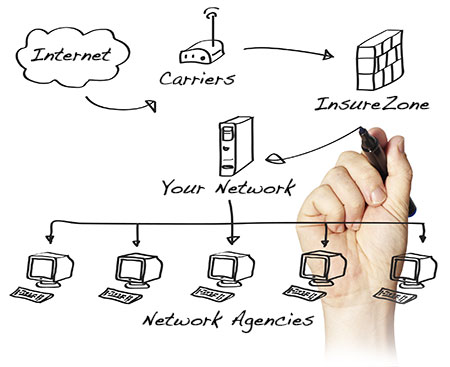

Leads 2.0 Real-time comparative quoting

Provide real-time rates to anyone in the world, 24 hours a day, with Leads 2.0! InsureZone enables you to provide real-time comparative quoting from your agency web site from multiple national carriers.More...